As scrutiny from the Health Resources and Services Administration (HRSA) increases and new pilot programs are launched, 340B compliance becomes even more challenging. HRSA’s posted audits for FY 2024 confirms the risks;

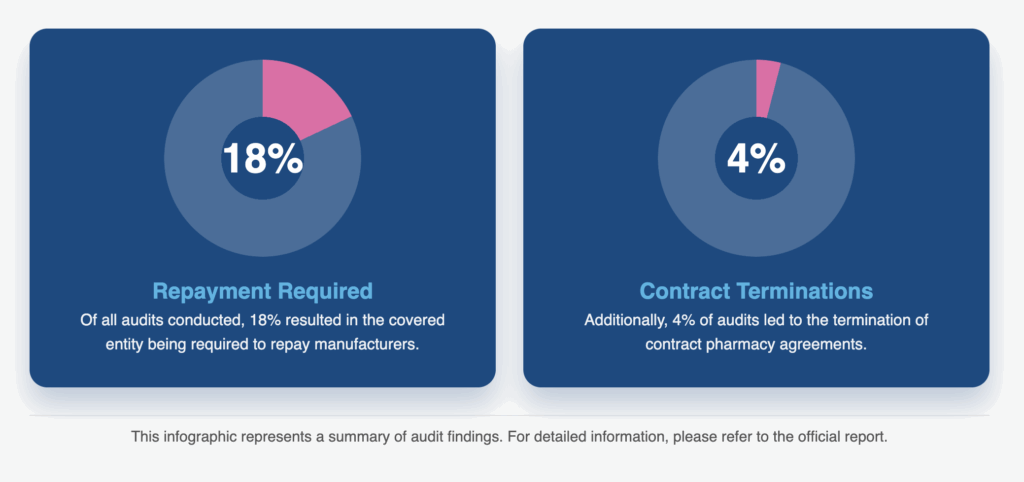

18% of audits required repayment to manufacturers; 4% required termination of contract pharmacies.

Common Compliance Errors that Can Jeopardize 340B Eligibility

HRSA’s findings also highlight something critical: the same errors appear year after year. Let’s take a look at the most common errors that can put your hospital’s eligibility at risk.

1. Incorrect 340B OPAIS Records

The most frequent audit finding, and often the simplest error, is inaccurate data in OPAIS. A single incorrect date or mismatch in OPAIS can flag the entire record as noncompliant.

In FY 2024, 62% of audits cited incorrect OPAIS records, with filing date mistakes in the Medicare Cost Report leading the category.

Bluesight’s 340BCheck supports hospitals by providing a Cost Report oversight and continuous sync with OPAIS data and focused workflows for responding to changes, flagging discrepancies before they trigger audit findings.

2. Duplicate Discounts (Medicaid Exclusion File Errors)

Duplicate discounts remain a top compliance trap. In FY 2024, 91% of duplicate discount findings came from inaccurate or incomplete MEFs.

When MEFs don’t align with actual claims, hospitals risk repaying manufacturers for improper billing. Even one incomplete submission can expose large volumes of claims.

Bluesight helps by cross-referencing eligible sites and locations against administration and TPA data to reduce the chance of inaccurate or incomplete submissions.

3. Diversion at Contract Pharmacies

Diversion findings were tied to duplicate discounts in 17% of all audit findings. The overwhelming majority (82%) involved 340B drugs dispensed at contract pharmacies for prescriptions written at ineligible sites. HRSA considers prescriptions from non-registered sites categorically ineligible.

Bluesight strengthens oversight of contract pharmacy diversion by confirming that prescribing sites and providers are registered and while auditing every transaction.

4. Repayment Requirements

18% of FY 2024 audits required repayment to manufacturers due to duplicate discount or diversion findings. Repayments drain 340B savings and can prove costly to already tight covered entity budgets. Once an error is identified, repayment is mandatory.

Bluesight reduces repayment risk by surfacing potential duplicate discount and diversion issues before they escalate to audit findings, allowing covered entities to remedy root causes.

5. Contract Pharmacy Terminations

Though less common, 4% of FY 2024 audits required termination of contract pharmacies, most often tied to OPAIS errors. Losing contract pharmacy access can severely impact a hospital’s ability to extend 340B savings to patients.

Hospitals that wait until HRSA arrives to identify weak points put themselves in jeopardy. Regular operational reviews and ongoing monitoring are the surest ways to preserve contract pharmacy relationships.

Bluesight safeguards contract pharmacy participation by monitoring OPAIS accuracy and pharmacy eligibility in tandem.

Mounting Legal and Legislative Pressures

HRSA audits are only part of the compliance landscape. New state laws add complexity, with multiple states enacting regulations to counter manufacturer restrictions on 340B drugs. Manufacturers continue to test contract pharmacy distribution limits, while legal battles over rebates and access restrictions remain unsettled. At the federal level, changes in Medicare Part B reimbursement policies are also likely to reshape compliance practices.

Hospitals can no longer rely on manual compliance processes. The volume of data and pace of regulatory change make it impossible to keep up by hand. Consistent reviews and updates require automation for continual monitoring. Without a system like Bluesight that’s regularly updated to adapt to constant policy changes, your eligibility will eventually be put at risk.

FAQs on 340B Compliance Challenges

Why are OPAIS errors such a recurring problem?

Because OPAIS requires precise, up-to-date data that hospitals often update manually. Filing date errors in Medicare Cost Reports alone accounted for most of the 62% of audits citing “Incorrect 340B OPAIS Records” in FY 2024. Manual entry inevitably leads to missed updates and inconsistencies.

Bottom line: without automated data checks, OPAIS errors are unavoidable.

What drives most duplicate discount findings?

In FY 2024, 91% of duplicate discount findings were tied to inaccurate or incomplete Medicaid Exclusion Files (MEFs). Manual MEF reconciliation is slow and error-prone. One incorrect file submission can expose thousands of claims.

Bottom line: automated reconciliation between eligible locations, administration data and TPA data is the only reliable fix.

Why does HRSA place such a strong emphasis on contract pharmacies?

Because contract pharmacy claims create the highest risk of diversion. In FY 2024, 82% of diversion findings involved prescriptions written at ineligible sites. Manual oversight can’t keep up with the volume of claims flowing through multiple pharmacies.

Bottom line: automated verification of prescribing sites and providers is essential.

How costly are audit findings?

Very. In FY 2024, 18% of audits required repayment to manufacturers, directly reducing 340B savings. Another 4% required termination of contract pharmacies, cutting off access altogether. Manual spot-checks can’t prevent these outcomes.

Bottom line: automated monitoring reduces the chance of repayments and contract terminations.

Can hospitals realistically stay compliant without automation?

No. The data proves it: the same manual-driven errors surface year after year: OPAIS mismatches, MEF inaccuracies, and contract pharmacy misalignments. HRSA audits are not slowing down, and state and federal regulations are only adding complexity. Bottom line: automation isn’t a nice-to-have; it’s the only path to sustainable continuous compliance.